WASHINGTON (MarketWatch)

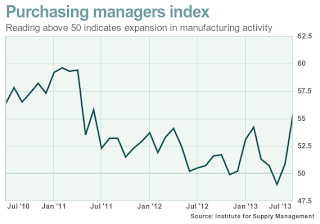

U.S. manufacturers reported a big jump in activity in July, with a key index reaching its highest level in over two years

The Institute for Supply Management said its July manufacturing index surged to a reading of 55.4% vs. 50.9% in June

That’s the highest level since June 2011

U.S. manufacturers reported a big jump in activity in July, with a key index reaching its highest level in over two years

The Institute for Supply Management said its July manufacturing index surged to a reading of 55.4% vs. 50.9% in June

That’s the highest level since June 2011

Economists polled by MarketWatch had expected a reading of

52.0%

Earlier, a similar survey conducted by Markit produced a

reading of 53.7 in July, the fastest rate of growth since March

Readings above 50 indicate expansión

The ISM numbers were unusually strong

The production index jumped 11.6 points

to a nine-year high of 65.0%

The new-orders component rose 6.4 points to 58.3%,

and the employment index leaped 5.7 points to 54.4%

The comments from the purchasing managers themselves were positive but not quite

as optimistic

“Overall conditions remain steady and slightly above prior year,”

said a manager in paper products

“Sales are holding steady. Business is good,” said a manager in furniture and

related products

3 comentarios:

WASHINGTON (MarketWatch)

Outlays for U.S. construction projects unexpectedly declined in June, the Commerce Department reported.

Construction spending fell 0.6% in June to an annualized rate of $883.9 billion. This was well below analysts' expectations of a 0.5% gain and the biggest drop in five months. But May construction spending was upwardly revised to 1.3% growth from the initial read of a gain of 0.5%. Both private and public spending fell in June.

WASHINGTON (MarketWatch)

The rate on the 30-year fixed-rate mortgage averaged 4.39% in the week ending Aug. 1, up from 4.31% last week, Freddie Mac said Thursday. One year ago, the 30-year averaged 3.55%. Interest rates have climbed in anticipation the Federal Reserve will curtail bond purchases later this year. The mortgage-buying giant said the 15-year fixed-rate mortgage edged up to 3.43% from 3.39%, the 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.18%, up from 3.16%, and the 1-year Treasury-indexed ARM averaged 2.64%, down from 2.65%. "Mortgage rates rose slightly leading up to the Federal Reserve's monetary policy statement this week," said Frank Nothaft, chief economist at Freddie Mac.

Producción industrial Italiana (MoM) 0.3% 0.4% 0.1%

GBP Producción industrial (MoM) 1.1% 0.6% 0.0%

Publicar un comentario