Welcome

stock market phases theorem.

Chief Artificial Intelligence.

Academic training in Fundamental Mathematics.

IA basada en Razonamiento Humano

Billie, Founder with academic training in Fundamental Mathematics and professional experience in Large Multinationals in the Information Technology sector, having held positions in high-level management positions, maintains that it is time to reduce Unproductive Public Expenditure and help the Private Sector in everything that is possible.

Cortesía de Investing.com

Cortesía de Investing.com

Agenda Macro

Calendario económico en tiempo real proporcionado por Investing.com España.

4 comentarios:

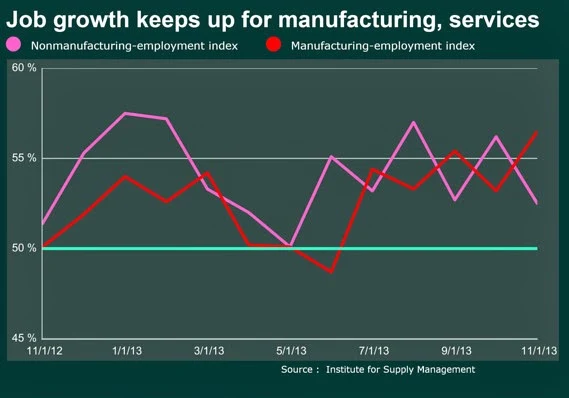

WASHIHNGTON (MarketWatch)

The U.S. economy expanded at a 4.1% annual clip in the third quarter, the strongest performance in two years, owing to faster consumer spending and more business investment in intellectual property such as software, according to newly revised government figures. The Commerce Department previously reported that gross domestic product had risen at a 3.6% annual rate. Consumer spending rose 2% instead of 1.4% as previously reported, though the increase in outlays was largely directed toward gasoline and health care. Business investment in software was revised up sharply to a 5.8% increase from 1.7%. Companies stockpiled $115.7 billion worth of inventories in the third quarter, barely changed from the prior reading. Trade also contributed a bit more to faster growth in the third quarter. The increase in exports was revised to 3.9% from 3.7%, while imports were trimmed to 2.4% from 2.7%. The annualized pace of inflation was little changed at 1.9% as measured by the PCE index, or just 1.4% on a core basis. Before the report, economists polled by MarketWatch had forecast GDP to be revised up to 3.7% in the government's final update

CAD PC subyacente (MoM) -0.1% 0.1% 0.2%

CAD Ventas minoristas subyacentes (MoM)

0.4% 0.0% 0.2%

CAD Índice de Precios al Consumo (MoM)

0.0% -0.2% -0.2%

CAD Ventas minoristas (MoM) -0.1% 0.3% 1.0%

USD Gasto Real de los Consumidores

2.0% 1.4% 1.4%

Freedom for the Countrys of the Eurozone

USD Baja Ingresos personales (MoM) 0.2% 0.5% -0.1%

USD Media Gasto personal (MoM) 0.5% 0.5% 0.4% Revisión de 0.3%

USD Baja Actividad Nacional del Fed de Chicago 0.60 0.30 -0.07 Revisión de -0.18

Publicar un comentario